Tax accounts

Sales tax account

The sales tax payment period (monthly, bimonthly, quarterly or annual basis) is selected in the Assumptions. You can add additional receipts of sales tax in the Other row.

USA account

Screenshot not shown here!

Non-USA account

Sales tax % is added for each product line in the Sales Projections, for each expense item in the Income Statement and for each type of asset in the Investment Budget.

Sales tax payments c.q. refunds will be calculated accordingly in this row and in the Cash Flow worksheet. A refund is shown as a negative number.

Use the Other rows to adjust tax to be paid. F.e. for some investments/expenditures your tax department may not allow any sales tax refund, or only allow the sales tax paid to be refunded in installments.

Screenshot not shown here!

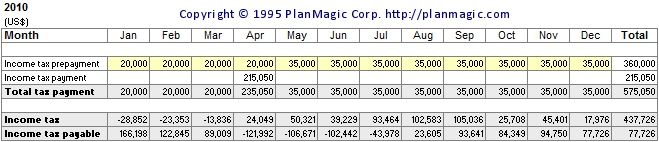

Income tax account

Enter any income tax prepayment in the rows provided. The month in which you expect to pay any corporate tax is selected in the Assumptions worksheet. The income tax payable amounts show up in the Balance Sheet.

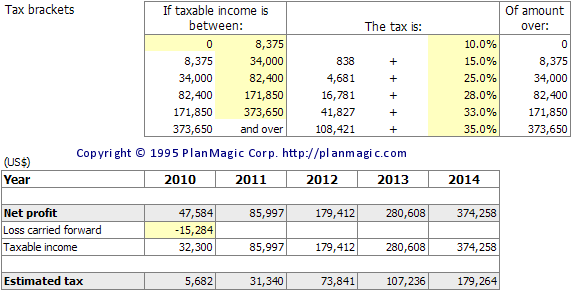

Income tax for a Sole proprietor / Partnership

These business forms do not pay corporate tax and the net profits are added to the owners' taxable income(s). Below you can estimate the possible tax payables by entering the tax brackets. These numbers are only informational and the estimated tax amounts are not linked to any worksheets.

These are the individual tax brackets for 2010 (Single Filing Status) in the USA. Tax rates progressively increase as income increases. The tax rates apply only to the income in each tax bracket range. Also, the tax rates apply only to taxable income. Various adjustments and deductions, including the standard deduction and personal exemptions, all lower a person's taxable income.

Adjust the values (yellow cells only) as is needed.